Mandatory Display

Basic details of the SB/DP such as registration number, registered address of Head Office and branches if any

| Stock Broker Name | Registration Number | Registered Address | Branch Address (if any) | Contact Number | Email ID |

|---|---|---|---|---|---|

| Pinnacle Forex & Securities Pvt Ltd | INZ000182337 | A-1307, O2 Commercial Bldg., Plot No.23-24, Near Minerva Ind. Estate, Mulund (W), Mumbai - 400080 | Shop No 110 Status Symbol, Chati Galli Solapur- 413002 | 022-61006100 | [email protected] |

| Depository Participant Name | Registration Number | Registered Address | Branch Address (if any) | Contact Number | Email ID |

|---|---|---|---|---|---|

| Pinnacle Forex & Securities Pvt Ltd | IN-DP-732-2022 | A-1307, O2 Commercial Bldg., Plot No.23-24, Near Minerva Ind. Estate, Mulund (W), Mumbai - 400080 | N.A. | 022-61006100 | [email protected] |

Names and contact details of all Key Managerial Personnel including the Compliance Officer -

| Sr. No. | Name of the Individual | Designation | Contact Number | Email ID |

|---|---|---|---|---|

| 1 | Arvind Murji Vinchhivora | Compliance Officer | 022-61006222 | [email protected] |

| 2 | Mehul Prakash Bhadra | Designated Director | 022-61006118 | [email protected] |

| 3 | Pradip Jamnadas Thakkar | Director | 022-61006100 | [email protected] |

Step by step procedures for opening an account, filing a complaint on designated email id, and finding out the status of the complaint etc.

a) Detailed write up on the procedure for opening an account along with Flowchart and video if any (optional).

Trading and Demat can be open Online OR Offline.

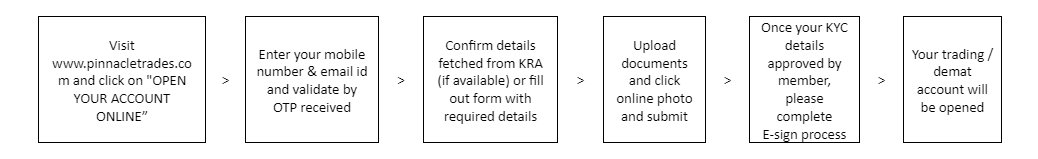

Steps to Open Trading / Demat Account Online:

Step 1: Enter Your Mobile Number & Email - To open trading / demat account, visit www.pinnacletrades.com and click on "OPEN YOUR ACCOUNT ONLINE", enter your mobile number & email id followed by OTP.

Step 2: Complete E-KYC - To complete the online KYC procedure, you must enter details like your name, address, permanent account number (PAN), date of birth, bank details, trading preferences, type and other details.

Step 3: Upload Supporting Documents - Upload required documents like identity proof, address proof, bank proof, income proof etc. to complete your eKYC process.

Step 4: E-signing KYC - Once your documents are verified, and the final formalities are completed, complete your account opening procedure by E-signing the form to Digitally Authenticate Your KYC.

Your trading / demat account will be opened.

Steps to Open Trading / Demat Account Offline:

Step 1: Fill in the application form - You will need to fill out an application form for opening trading / demat account. Along with this, you will need to submit a list of documents such as Identity Proof, Address Proof, PAN card, Bank details, segment details, your personal details, nomination details etc.

Step 2: Verification process - You will be given a list of rules and regulations to ensure ethical and legal trading, and to clear any doubts you may have regarding holding a demat-cum-trading account and the different functions it serves. The member will conduct an in-person verification of you and your KYC documents.

Step 3: Final approval - Once your documents are verified, and the final formalities are completed, your trading / demat account will be opened.

b) Detailed write up on procedure for filing a complaint on designated email id/ Toll-free number along with Flowchart and video if any (optional). Provisions are to be made for sharing Ticket Number once the complaint is lodged.

The regulator has made it mandatory for each broker member to have a dedicated mail Id for the investor / customers to make his complaints / grievances with the member, and the broker is required to resolve such complaints within a reasonable time after the receipt of such complaints. The company has formed a mail ID [email protected] on the Pinnacle Forex & Securities Pvt. Ltd website to receive and address the grievances of the investors as and when they become our client/customer.

The mail ID will be accessed by the following personal from the company: -

- Designated Director

- Compliance Officer

- Accounts / Back-office

The company shall ensure that once a complaint is received from the customer/investor, the same is attended as a top priority and provide the reply regarding the investor query as soon as possible depending on the complexity of the complaint. Many times the client enquire for information also on the investor grievance email id, then in such cases the compliance officer will bifurcate the email received as an investor grievance email or an enquiring email. In case if it is an enquiring email then the same is required to be replied within a maximum of 3 working days. In case if it is an investor grievance then the same has to be replied after thorough study within a period of 7 working days. In case the compliant/query is of such nature that it requires the attention and discussion of the senior management, then the said complaint/grievance should be discussed by the Investor Grievance Committee and a suitable solution must be communicated to the investor/customer at the earliest.

Types of Investor Grievances / Complaints: -

| 1. Non-receipt / delay in payment: | 11. Excess brokerage |

| 2. Delay in refund of margin payment | 12. Non-execution of order |

| 3. Non settlement of accounts | 13. Wrong execution of order |

| 4. Non-receipt / delay in delivery or transferring securities | 14. Connectivity / system related problem |

| 5. Non-receipt of documents | 15. Non-receipt of corporate benefits |

| 6. Non receipt of Bills/ Contract notes | 16. Other service defaults |

| 7. Non receipt of Account statements | 17. Closing out / squaring up |

| 8. Non receipt of copies of Rights & Obligation Documents. | 18. Dispute in Auction value / close out value |

| 9. Unauthorized trades / misappropriation | 19. Non implementation of arbitration award |

| 10. Service-related issue. | 20. Others |

c) Detailed write up on procedure for finding out status of the complaint basis Ticket Number etc. along with Flowchart and video if any (optional).

Details of Authorised Persons - Please click here

List of Authorised Persons (AP) Cancelled by Members on Account of Disciplinary Reasons - Nil